Explain Differences Between Surplus Deficits and Debt

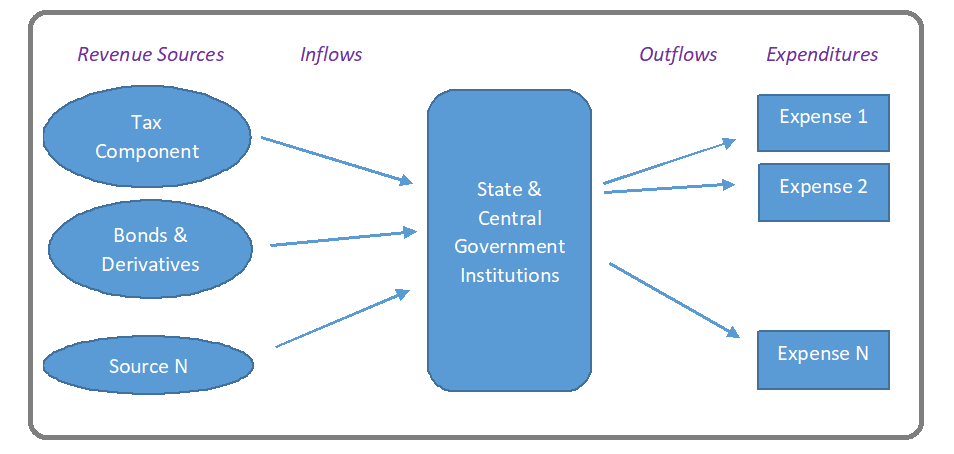

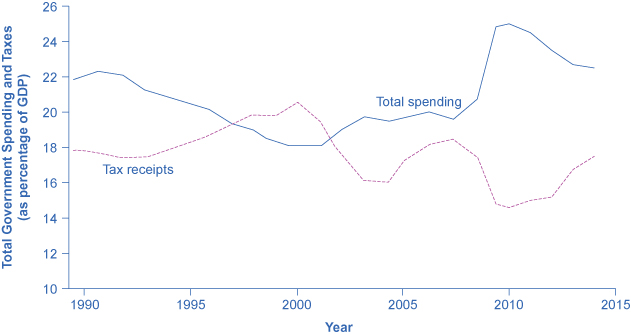

The deficit is the difference between what the US. In simple terms a budget deficit is the difference between what the federal government spends called outlays and what it takes in called revenue or receipts.

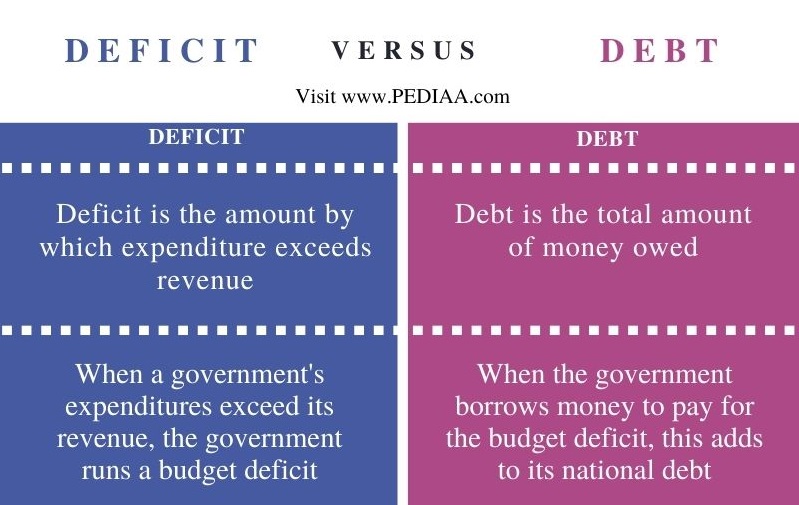

What Is The Difference Between Deficit And Debt Pediaa Com

Government takes in from taxes and other revenues called receipts and the amount of money it spends called outlays.

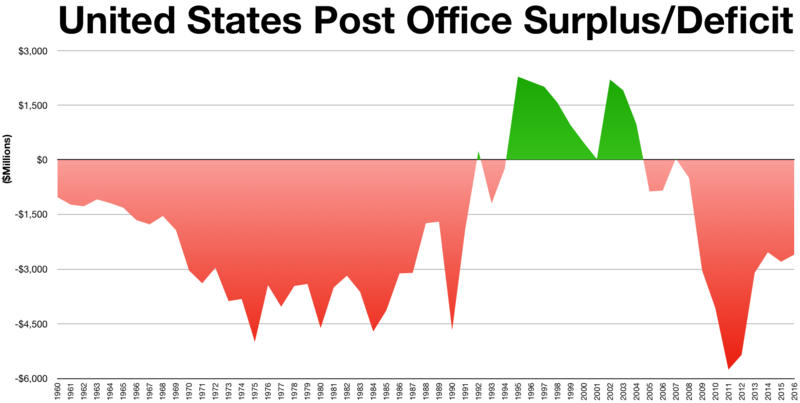

. Use the Marginal Income Tax Rates in Figure 156 see p. A deficit budget situation means that the expenses of a government has exceeded the tax income during that period whereas a surplus budget scenario means that the tax income of a government exceeds its expenses. In general budget deficit is very common while.

Official reserve transactions are relevant under the reign of the fixed exchange rates. The difference between budget deficit and national debt are explained in the following points in detail. Federal Debt from the Concise Encyclopedia of Economics.

Debt can be kept for a limited period and should be repaid back after the expiry of that term. Conversely Equity reflects the capital owned by the company. Greece Ireland Portugal and Spain all went through.

To lose two pounds per week double it to 1000 calories per day. You can think of the total debt as accumulated deficits plus accumulated off-budget surpluses. A surplus budget normally refers to the financial conditions of the governments.

The budget deficit means spending more than cashing in while the national debt means money owed. Understand the difference between a deficit and a debt and how the two are related. Have a basic understanding of how supply side economics changed the debt situation in the United States.

Debt is the sum of money owed by the. Main Differences Between Surplus and Deficit The term surplus means that the revenue generated is more than the expenditure while the Deficit means that the. However individuals choose to use the term savings rather than budget surplus.

Receipts include the money the Government takes in from income excise and social insurance taxes as well as fees and other income. That is to say the deficit is how much more expenses over a certain period of time exceed income or in the case of the public deficit how much government spending over a year exceeds tax income. Know the differences between a federal budget deficit a surplus and a balanced budget.

Tax due on taxable income of 100000 200000 and 500000. The deficit is defined as the shortfall of the countrys income over expenses. Outlays include all Federal spending including social security and.

The decrease or increase in official reserves is known as the overall balance of payments deficit or surplus. Explain the difference between a budget deficit and the national debt. 463 to compute the following.

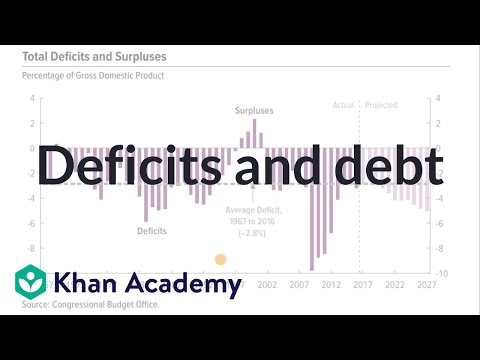

In the case of. The deficit is negative whenever the value of outstanding debt falls. Explain how the national debt in the United States has evolved over the years.

A surplus budget is a condition when incomes or receipts overreach costs or outlays expenditures. The national debt also known as the public debt is the result of the federal government borrowing money to cover years and years of budget deficits. The deficit is the difference between the money Government takes in called receipts and what the Government spends called outlays each year.

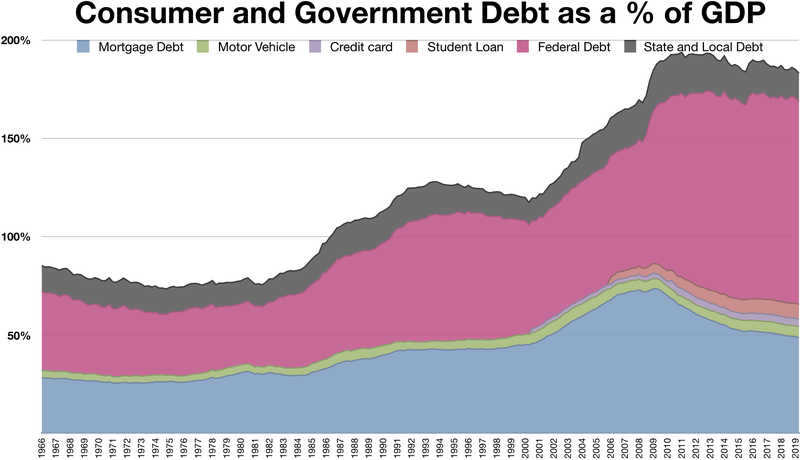

The fundamental hypothesis is that the monetary authorities are the final financiers of any deficit in the BoP or the recipients of any surplus. If youre trying to lose one pound you need to create a calorie deficit of 500 calories per day over seven days 500 calorie deficit per day x 7 days per week 3500 calorie deficit per week. Public debt with the debt of other advanced industrial nations.

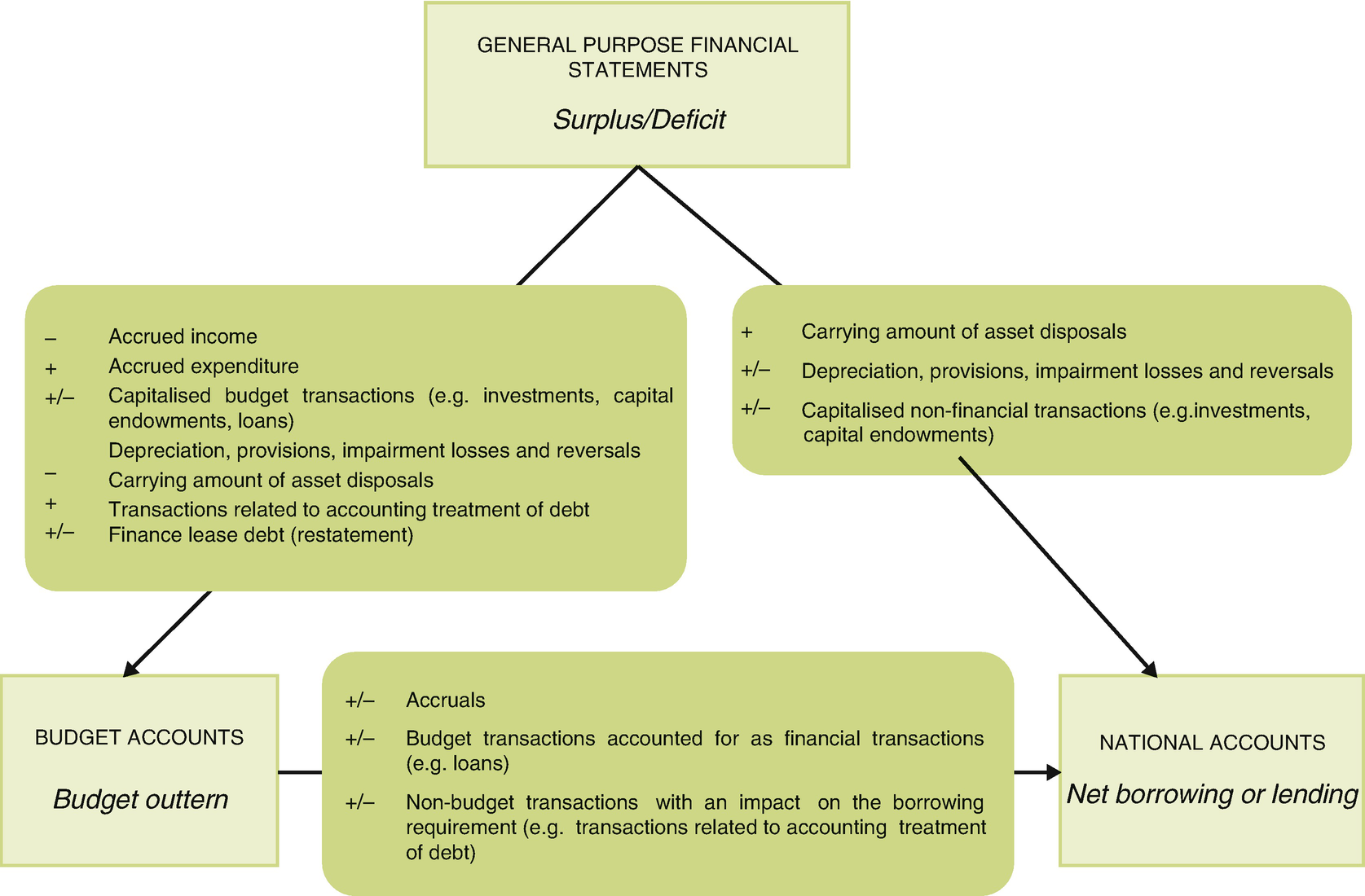

Compare the size of the public debt to GDP. Some of the main differences between budget surplus and budget deficit are listed below. A deficit is a flow variable and a debt is a stock variable.

More than there being an easily noticeable difference between the two they are actually connected. Explain the relationship between the government budget deficit and the trade deficit-often accompany each other. State the differences among the different debt.

Discuss current thinking on fiscal policy. The same numbers work for gaining weight but in reverse surplus instead of a deficit. Compare interest payments on the public debt to GDP.

The deficit is the major cause of a countrys debt as when there is a. Surplus is a manifestation that the government is being effectively. The types of economic Surplus are consumer surplus and producer surplus while types of Deficit are a Trade deficit and.

Debt is the borrowed fund while Equity is owned fund. A negative deficit is called a surplus. Experts are tested by Chegg as specialists in their subject area.

The federal debt. The federal deficit or surplus refers to what happens with the federal government budget each year. The public or Federal government debt is accumulated over time.

Understand the long-run and short-run effects the deficits and debt have on real GDP-in a short-run recessionary gap government deficit. The shortfall of the countrys income over expenses is termed as deficit whereas the sum of money owed by the nations government to others is. On the other hand Equity can be kept for a long period.

Well talk more about the national debt on the next page. Explain the relationship of budget deficits and surpluses to the public debt. Average tax rate on taxable income of 100000 200000 and 500000.

The national debt is an accumulation of budget deficits to which money owed to other countries is added. The items included in the deficit are considered either on-budget or off-budget. We review their content and use your feedback to keep the quality high.

List the major types of owners of the public debt. A good way of judging the size of the federal debt and hence its likely effect on the economy is as for an individual to take it as a ratio of income. Debt reflects money owed by the company towards another person or entity.

The difference between the deficit and the debt lies in the time frame. The difference between budget deficit and national debt are.

Difference Between Surplus And Deficit Difference Between

Government Budget Balance Wikiwand

Adjustment Categories And Conceptual Differences Between Ga And Na Download Table

Deficit Vs Debt Top 9 Differences To Learn With Infographics

What Is The Difference Between Deficit And Debt Pediaa Com

Federal Deficits And The National Debt Principles Of Economics 2e

1 Chapter 12 Budget Balance And Government Debt 2 Budget Terms A Budget Surplus Exists When Tax Revenues Are Greater Than Expenditures And Is The Difference Ppt Download

Budget Deficits And The National Debt The Budget Balanced Budget Balanced Budget When Revenue Equals Spending Budget Surplus Budget Surplus When Ppt Download

Fiscal Policy The Relationships Between Budget Deficits Surplus And National Debt Youtube

Difference Between Surplus And Deficit Youtube

Difference Between Surplus And Deficit Difference Between

Accounting For Public Debt And Deficit Springerlink

Difference Between Surplus And Deficit Difference Between

Part 2 Deficit And Debt Chapter Chapter Goals Define The Terms Deficit Surplus And Debt And Distinguish Between A Cyclical Deficit And A Structural Ppt Download

Deficits And Debt Video Khan Academy

Pdf The Budget Surplus Objective An Example Of How Economics Is Broken

Difference Between Surplus And Deficit Youtube

Part 2 Deficit And Debt Chapter Chapter Goals Define The Terms Deficit Surplus And Debt And Distinguish Between A Cyclical Deficit And A Structural Ppt Download

Comments

Post a Comment